tax on venmo over 600

1 2022 a provision of the 2021 American Rescue Plan requires earnings over 600 paid through digital apps like PayPal Cash App or. Currently online sellers only received these forms if they had at least.

The change to the tax code was signed into law as part of the American Rescue Plan Act the Covid-19 response bill passed in.

. WJBF A change from the IRS may complicate next tax season for small business owners who use apps like Venmo or PayPal. SYRACUSE NY WRVO If you had a side hustle in 2021whether it be selling homemade candles or walking your neighborhood dogsthis years tax filings may look a bit different for you. While Venmo is required to send this form to qualifying users its worth.

The previous reporting threshold was 20000. New tax law. Millions of small business owners in.

Venmo Cash App to report business transactions over 600. Dont Believe The Hype Bidens 600 Tax Plan Wont Force You to Report All Venmo Transactions to the IRS TRENDING 1. Social media posts like this TikTok video that was published on September 26 and racked up 340000 views have claimed that starting January 2022 if you receive more than 600 per year through third-party peer-to-peer payment apps like Cash App Venmo or Zelle you will be taxed on those transactions.

The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600. Starting in 2022 businesses with commercial transactions totaling at least 600 a year for goods or services via digital payment apps such as Venmo or PayPal will receive a 1099-K form for transactions completed in 2022 and going forward. PayPal Venmo and Cash App to report commercial transactions over 600 to IRS.

If you receive 600 or more payments for goods and services through a third-party payment network such as Venmo or CashApp these payments will now be reported to the IRS. 1 the IRS said if a person accrues more than 600 annually in commercial payments on an app like Venmo then Venmo must file and furnish a Form 1099-K for them reporting. According to FOX Business.

No Venmo isnt going to tax you if you receive more than 600. 1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more than 600 per year to the Internal Revenue Service. Under the American Rescue Plan Act people who sell goods or services on platforms like Etsy eBay and other sites that use third-party transaction networks like PayPal Cash App and Venmo will be issued a tax form called a 1099-K for online sales totaling 600 or more starting next year.

As long as youre not making additional income over 600 via these apps you should be in the clear. Ad Get 10 When You Sign Up For Venmo. Yes users of cash apps will get a 1099 form if annual payments are over 600 but that doesnt mean extra taxes.

If youre among the millions of people who use payment apps like PayPal Venmo Square and other third-party electronic payment networks you could be affected by a tax reporting change that goes. Starting the 2022 tax year the IRS will require reporting of payment transactions for goods and services sold that meets or exceeds 600 in a calendar year. One Facebook post claims the new tax bill would tax transactions exceeding 600 on smartphone apps like PayPal and Venmo.

As of Jan. January 19 2022 204 PM 2 min read. Beginning with tax year 2022 if someone receives payment for goods and services through a third- party payment network their income will be reported on Form 1099-K if 600 or more was processed as opposed to the current Form 1099-K reporting requirement of 200 transactions and 20000.

1 if a person collects more than 600 in business transactions through cash apps like Venmo then the user must report that income to the IRS. Business Venmo transactions over 600 taxed. Rather small business owners independent contractors and those with a.

The IRS is cracking down on the apps to make sure everyone is paying their fair share of taxes. Just Fill Out Your Info Including Your Mobile Number Get 10 When You Sign Up For Venmo. Per last years American Rescue Plan Act so-called peer-to-peer payment platforms like Venmo.

Starting this month users selling goods and services through such popular sites as Venmo Etsy and Airbnb will begin receiving tax forms if they take a payment of more than 600. AT the start of the New Year business owners using third-party payment processors were forced to report 600 transactions or higher to the IRS. Under the IRS new rules the online payment giants such as Venmo PayPal and Cash App were told to report commercial transactions of 600 or higher starting January 1.

Americans for Tax Reform President Grover Norquist discusses the impact of third-party payment processor apps. Payments of 600 or more through third-party payment networks like Venmo Cash App or Zelle will now be reported to the IRS. Anyone who receives at least 600 in payments for goods and services through Venmo or any other payment app can expect to receive a Form 1099-K.

That means if you borrow money using any of those things over. This new rule does not apply to payments received for personal expenses. Offer Ends On March 31 2022.

Third-party payment processors like Venmo PayPal and Cash App are now required to report a users business transaction to the IRS if they exceed 600 for the year.

Anyone Who Receives At Least 600 In Payments For Goods And Services Through Venmo Or Any Other Payment App Can Expect In 2022 How To Apply Goods And Services Venmo

Changes To Cash App Reporting Threshold Paypal Venmo More

Paypal Venmo And Cashapp Will Report Taxes Exceeding 600 To Irs As Biden Government Passed The Law

Venmo Paypal Must Report Your Side Hustle To The Irs If You Make More Than 600 A Year Abc7 Southwest Florida

No Venmo Isn T Going To Tax You If You Receive More Than Us 600 Tech

![]()

Fact Or Fiction The Irs Will Track Payments Over 600 On Paypal And Venmo In 2022 List23 Latest U S World News

Pin By Groundtofork On Useful Info In 2022 Give It To Me Goods And Services Venmo

No Venmo Isn T Going To Tax You If You Receive More Than Us 600 Tech

What To Know About The Irs New Reporting Requirements For Venmo Paypal And Other Payment Apps

New Venmo Tax Law Are You Filing Correctly Behindthechair Com

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

Federal Government To Ask For Taxes On App Transactions Over 600

New 600 Tax Law In 2022 Money Apps Tax Law

Advice On Venmo Having To Submit Sums Over 600 To The Irs R Personalfinance

Venmo Paypal Cash App Must Report Payments Of 600 Or More To Irs Kiro 7 News Seattle

Irs Requires Venmo Paypal And Zelle To Report Transactions Of 600 Or More

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You

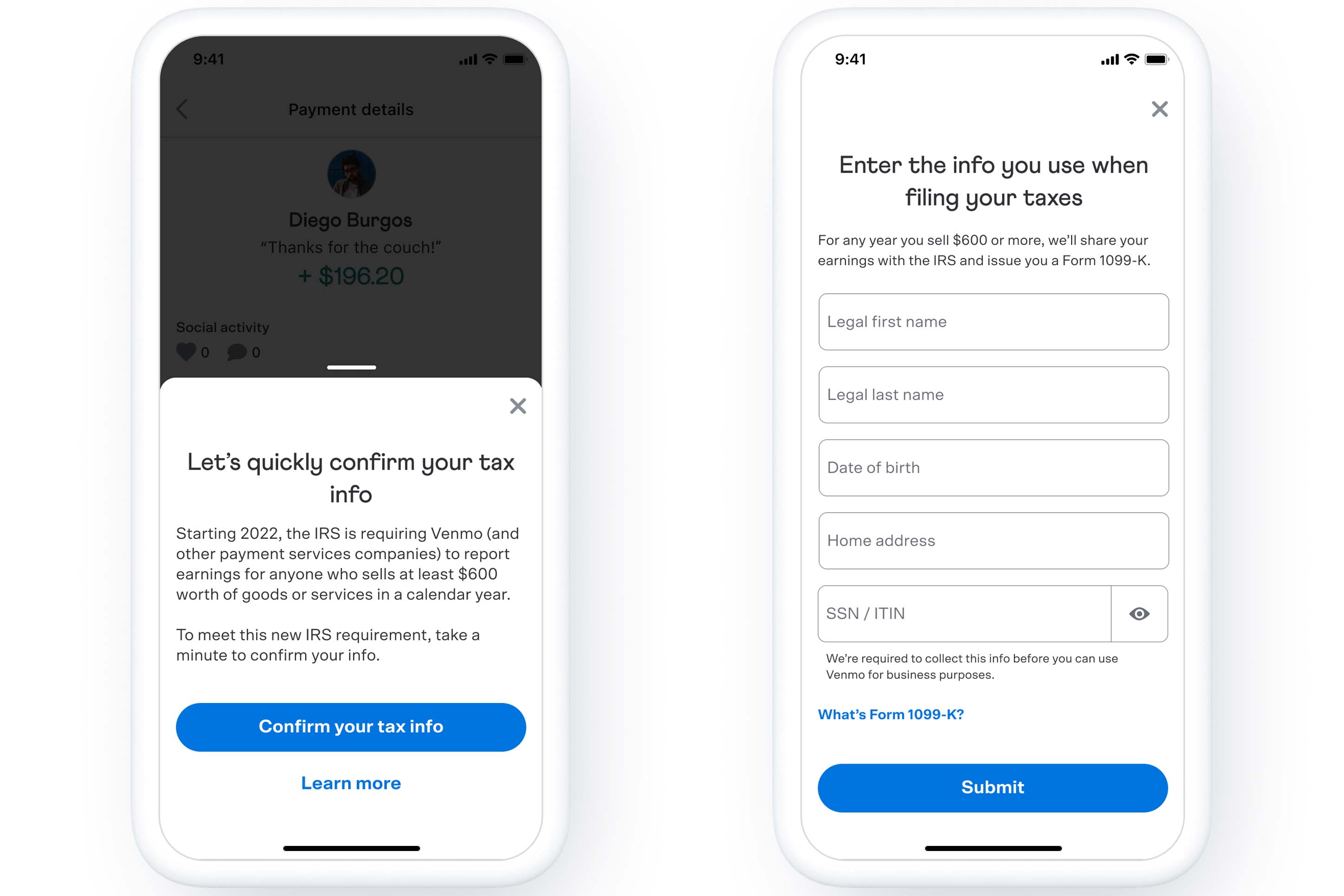

Press Release How To Confirm Your Tax Information To Accept Goods Services Payments On Venmo In 2022